It seems as though it’s everyone’s dream to own property these days, whether it be for the security of accommodation or just for investment purposes. All my peers seem to think that it is an easy “get rich quick” debacle once you have a few thousand pounds saved. All these hopes and dreams are centred around London, the city of opportunity. Why not? London is an amazing place full of elite properties. It seems that we all want the same thing, right? However, the fundamental price determination principle of supply and demand is the reason why this dream of owning a house in London threatens to remain just that… A dream. Here are my thoughts on the situation.

When you think of London, you think about over-saturation. Over-saturation in the sense that everyone has the same idea and drive as you; to buy property. However, it is important to remember that, unlike the baby boomer generation who enjoyed periods of economic boom and wealth, we the millennials inherited a financial crisis and economic stagnancy. In addition to this, the London property market is facing a big lack of supply to accommodate the number of people wanting to buy. In my opinion, this scarcity is due to 2 main factors. On one hand, the baby boomers own more than half of the UK’s wealth amounting to approximately £2.4 trillion. As millennials, we can only hope to acquire wealth at the same rate as our predecessors did. What is unfortunate here, is that a lot of this wealth was harboured off the property boom of the 1990s. Due to the immense wealth that this boom brought for them, the baby boomers are reluctant to sell their properties, contributing to the home shortage in London. On the other hand, we have the effect of foreign investors using property in London as a storage unit for their wealth. New builds in London are quickly acquired by Middle Eastern and Chinese foreign investors which price young people out of the most exclusive areas in London, further increasing the scarcity of affordable homes within the capital. There is a war on two fronts being fought here, and millennials seem to be losing the battle.

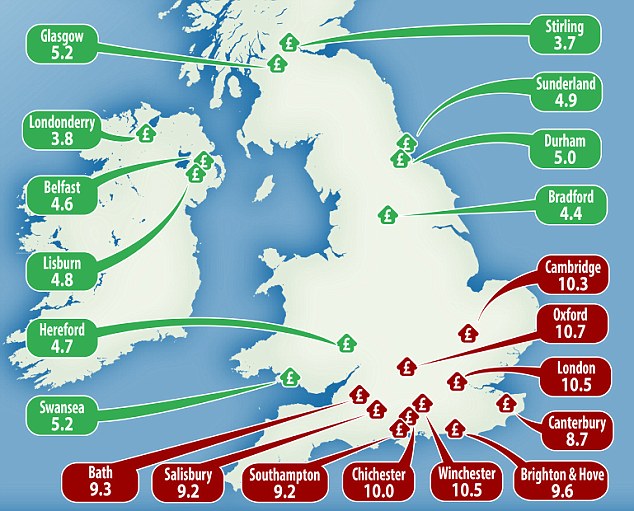

When you take all of this into consideration, you can begin to understand some of the reasons for London being so expensive. People being priced out of London even creates a ripple effect on the prices of the outskirts and the southern regions of England, because of the displacement of millennials. If it is property investment you are looking for, perhaps it would be smarter to look towards the midlands and northern regions of the UK. In my opinion, the bigger picture of the UK market is not properly represented because of the bubble in London. Regional housing markets paint a better picture for millennials as the affordability there is more attractive. The image below shows the most affordable cities (green) compared to the least affordable (red) the numbers show how much more than the

average salary one would need to buy a home.

Forecasts from the Royal Institution of Chartered Surveyors (RICS) and Hometrack suggests that 2018 will see a mini-boom in the regional housing market. What this means for you and me, is that the rise in house value within these regions will encourage property owners to sell. They will be adding more homes to the market which are still relatively affordable for millennials to buy, despite the rising house value. It is not all doom and gloom. If you are buying to invest, do not just go for a property in a city that has very cheap homes like Durham, where the average price for a home is approximately £97,000. It is important to know why that house is cheap. In such a city, is demand for a house high? If the incentive for people to live there is low, why would the value of that house increase over time? It could

turn out to be a low yield investment and a waste of your time.

As of March 2018, we are seeing houses in the regions of Manchester, Liverpool and Leicester among others, raise in value; over 6% per annum. This is contrasted with London’s recent lull

in prices.

I encourage you to be smart with these matters and take advantage of the support out there for first-time buyers such as help to buy schemes or shared ownership. If you play your cards right, you can put your cash in a good property that can beat inflation and earn you some good money.

With that being said, I believe that our money as young people can be invested elsewhere or at least, diversified between property and shares. As it stands today, the property market is no more the haven it once was, and this is the myth of the housing market that young people believe. By normal accounting definitions, a home would be classed as an asset. However, until that mortgage and interest are fully paid off it remains a liability. Even though it has value, it is not making you any money and is technically taking money from you. Unless you rent it out afterwards, it will continue taking money from you and not make you a penny. In an unfortunate economic climate, the property might drop in price; less than what you bought it for, potentially giving the property negative equity (when the market value of a property falls below the outstanding amount of a mortgage secured on it). Honestly, that is not something I would wish on an enemy. Suddenly, renting does not seem so bad now does it? It shouldn’t. Despite criticism, renting has some benefits attached to it. You have more variety and mobility, ideal for people early in their career who need to jump from city to city for job commitments.

I will end with this. The 2008 financial crisis and the collapse of the mortgage market have resulted in banks imposing stricter practices regarding mortgage limits. Now more than ever, they want to be certain that mortgage payments can be met. That means they are strict with deposit limits and credit scores etc.

Millennials also do not acquire wealth at the same rate as previous generations. And wage stagnation with inflation rates increasing means that disposable income is lower. As you can see, the odds are stacked against us. Please do not be drawn in by the pressure to own a home as soon as possible. Especially if you are a Londoner. The London property market needs time to realign itself. Do your due diligence, do your research and figure out whether it fits in with your financial goals. The world is changing, and so should our thoughts about the property market that have been passed down to us.