Department stores were once heralded as an innovative idea in retail, who wouldn’t want to go to a store that has almost everything available? But over the past, five to ten years, department store footfall and sales have drastically declined, not just in the United Kingdom, but globally – with large brands in the United States, Russia, Japan, and China also struggling. Looking further than the rather elementary notion that ”the internet/online shopping ruined everything”, there are many reasons as to why department stores aren’t doing as well as they used to, but there are also many ways we can attempt to revive them to make them fit for purpose in an ever-changing and rather difficult retail climate.

The Customer Experience

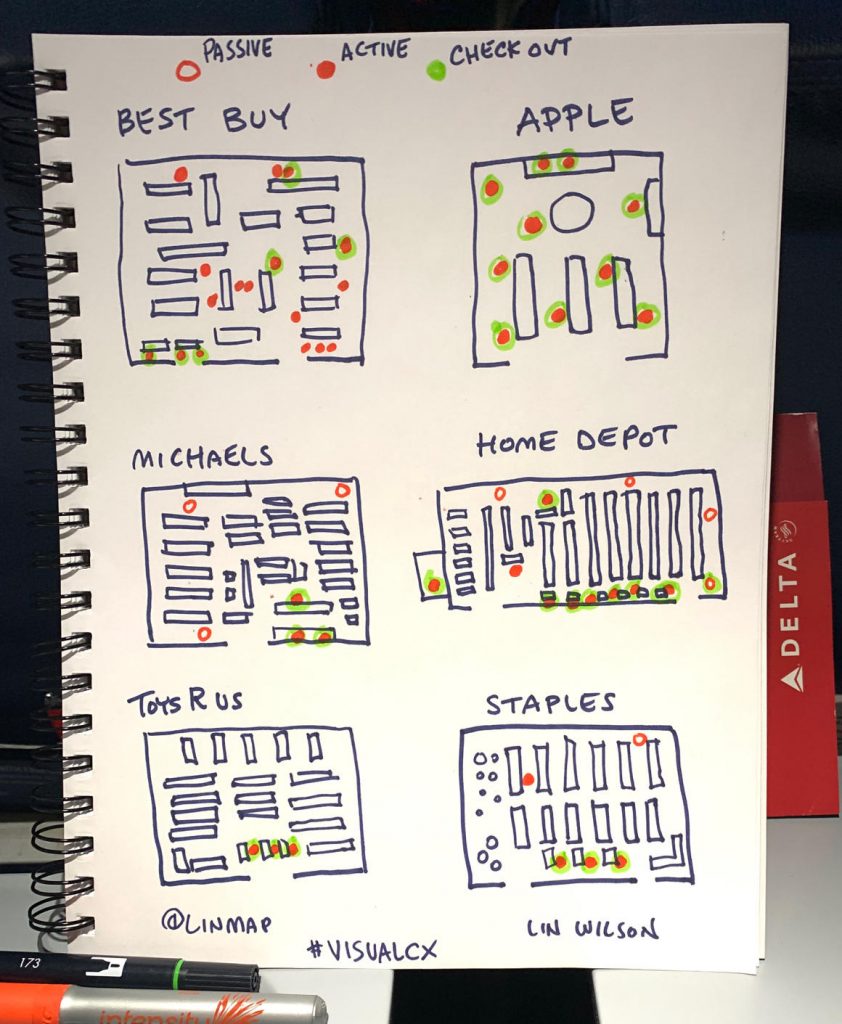

Let’s first address the more operational concerns and potential remedies for those. I recall seeing a simple drawing on a LinkedIn post not too long ago and found it quite interesting. Many spectators including myself have spoken about the importance of the customer experience in retail and how it can make or break businesses in general. This drawing illustrated the problem with large companies such as Toys’R’Us, Best Buy, and Staples when it came to serving customers in-store, in comparison to newer brands such as Apple.

To explain the drawing in slightly more detail, the orange dots are active employees, who are sometimes only at check out and will generally engage with the customer, the outline dots are the passive employees, stocking product, their main role and concern aren’t really to serve customers and lastly, the green dots, which are the checkout areas.

As someone who has consistently worked in retail, and has seen some of the best and worst of it – the drawing definitely raises some good points and questions. With the stores in question being as large as they are, being able to access staff quickly is quite important. Apple does a great job of this, but as a tech brand known for its sleek design and minimalist look – that is expected of them. Customer engagement is at the centre of the customer experience, yet as time went on, department stores got worse in this area, at a time where brands were moving towards experimental and experience-led initiatives in-store. A lot of this can be put down to internal matters such as poor staffing, lack of training or bad management, but it doesn’t negate the fact that a large review of this is necessary.

Interior Design & Spatial Planning

The store layout and design are some of the many imperative factors that will determine footfall. Whether they choose to come in and browse, make quick impulse purchases and come back again in the future to see what more the store has to offer; depends on how easy the store is to navigate and if the newer, more high-value products can be seen. In a department store setting, it is has proven difficult to get this right.

If you ask most people about their experience with department stores, most would say that “it’s been the same for years”, which most certainly isn’t a positive thing in this climate or retail in general. Ensuring that the right products are on display and that space is being maximised in-store is important, to engage customers with new merchandise, brands and to keep them coming to explore over and over again. In large, flagship stores, coordinating in-store moves will be significantly more difficult. This is why unveiling departmental changes and new services being offered could bring about more opportunities.

Not enough money is being spent on store refits and upgrading shop floors, especially in department stores outside of London. Being able to shop in stores that look fantastic and have clearly been well designed and invested in, all add to the experience. Another issue with many of these stores is the buildings that they are in. Granted, it is difficult to find buildings of this size and stature for retail use, however, it is important to consider how viable these buildings are for the modern shopping experience. If department stores were to be designed from scratch now, I predict that almost all of them wouldn’t be designed in the same fashion.

Size

Question. How big do department stores really need to be? I know that the size is part of the traditional USP, but I do think that stores can be a lot smaller and more productive. This would inevitably cut down on rent and a host of other costs for retailers. As an example, maybe there doesn’t need to be a travel or luggage department in every single chain of a store. Perhaps that can be reserved for the larger and more central locations so that more focus can be on other more profitable departments such as home, womenswear, and beauty. This would also allow stores to upgrade and improve their online presence, to ensure customers can access departmental products they can’t get to in-store.

The American department store chain, Kohl’s made this step two years ago. Despite the downturn in the retail market, they acknowledged the merit of bricks and mortar stores and maintained them, but the company moved away from its 80,000-square-foot stores in favour of stores that are between 35,000- and 55,000-square feet. They were able to utilise customer data to determine which brands and product types will perform best in a finetuned version of the store.

Location

In April, Debenhams named 22 of the 50 stores that it planned to close as part of a plan by new owners to revive the department store chain. Location is one of the most important things when speaking of property and how successful/unsuccessful it can be, but even more so for retailers. The past two years have seen many retailers downsizing in terms of locations and picking the poorest-performing stores to cross off their lists. While this is rather unfortunate for the many who have lost their jobs in working there and for the local community in the short term, in the long term it may not be such a bad notion.

Perhaps we should begin to come to terms with the fact that department stores, don’t exactly need to be in every corner. The benefit of having an in-centre department store is usually the fact that it is an anchor store – occupying the most space and bringing in the most customers (usually), even if there are visitors who haven’t heard of the brand before, they are more likely to visit the store if they are browsing around a shopping centre, than in comparison to passing a stand-alone store on the street or driving around the area.

Leasing

Increasing rents has always been a problem. In England and Scotland, legally most leases contain upward-only rent reviews, meaning that the rent can only increase after the renegotiation stage. The tenant can demand a new lease after the end of the lease term which is subject to fair market conditions – the problem? Quite a lot of department store leases are 30-40 years long. Many retailers have had a real problem with this over the years, some of whom are Debenhams, Marks & Spencer and House of Fraser. Years of upward only rent reviews have had significant impacts on retail portfolios and grouped with online competition and higher business rates, the very notion of upward-only rents is certainly the icing on a pretty terrible cake.

The market has traditionally always favoured landlords, with them having more bargaining power when it comes to negotiations – which is one of the many reasons why downward rent reviews, couldn’t be feasible. The industry needs to see a dramatic change and reach a compromise in the way in which it deals with ever increasing rents. There are still many retailers who are trading well, despite market conditions – who could come together to facilitate some change in relation to leasing in the future.

Experiment

Asset management is an exciting area of business, especially in retail. Being able to think of new and creative ideas to maximise assets has helped many retailers to stay competitive in a harsh market. There needs to be more of this in relation to department stores. Understandably, these kinds of investments and utilisation of spaces have been reserved for the flagships, but introducing them into regional stores could create many new opportunities not just for the retailer but for the local community too.

The last thing you’d want is redundant space within a store, so why not use it for something else? Pop-up spaces for brands? Leisure space, think gyms or wellness? How about food courts or small groceries – there needs to be more experimenting in the sector if it wants to move forward.

All in all, the department store will live on, but just not in a traditional aspect. There needs to be a complete transformation, not just from retail occupiers, but also by landlords and asset managers. Only then, could we begin to see a change in how department stores are perceived and bring them back into the forefront of retailing.