That’s why the title of this piece is so ridiculous.

‘Tycoonship’ (I think I’ve made that word up, but I like it) is a term of 0.001%. But I don’t think it is out of reach if you pay attention to specific out of the box investment ideas.

I want to introduce an investment vehicle to you – a REIT. This is a Real Estate Investment Trust.

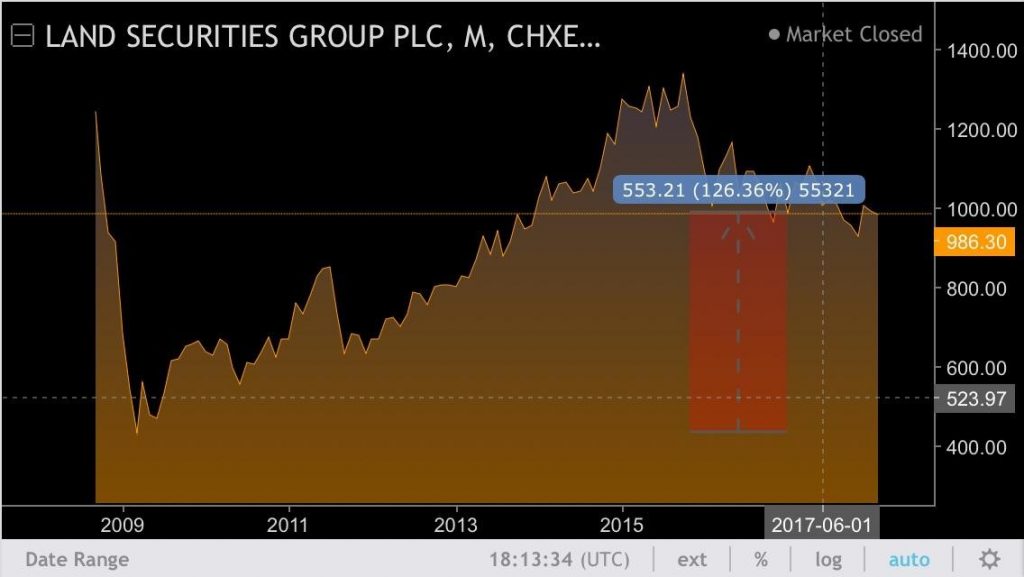

These are actively traded funds on stock markets that contain a portfolio of different property groupings. Let’s unpack a very well known REIT, Land Securities Group PLC, to see what is in it.

‘The Company’s Retail portfolio has a floor space of approximately 17.45 million square feet, which includes over 10 shopping centres, approximately 10 retail parks, over eight standalone leisure assets, and approximately 30 Accor Group hotels in the United Kingdom. The Company’s London Portfolio includes all the London offices and central London shops. Its London portfolio has a total floor space of approximately 6.16 million square feet, which includes west end offices, city offices, mid-town offices, inner London offices and central London shops, among others.’

Yikes… that’s quite big. Owning a few shares of these guys makes you a theoretical tycoon already. What I’m more interested in though is the money-making element.

How can my pocket benefit?

Take a look at the following chart.

Since 2009, the price of the REIT has grown by 125%.

If you were to buy a house based on being a mortgage lender, which would require a deposit, upkeep costs, alongside interest paid, I’m not too sure the growth in your house price would be reflected that well against owning a REIT such as Land Sec PLC.

As a note, I’m totally considering this from an investment point of view, not the utility one can gain from living in a house with a mortgage.

What’s more, you earn a yield yearly for owning a REIT. Think of this almost as rental income. This is because the company distributes taxable income amongst its shareholders.

So you really have two benefits here.

Firstly, you own a liquid asset which you can sell at any point, unlike with owning brick and mortar; secondly, you remain invested in the property while not being subject to issues with interest payable; and thirdly, not having a huge liability sitting on your balance sheet since buying a REIT is considered an asset. The biggest benefit to young people like you and I (is 25 young anymore?) is that this can be maxed out in your stocks and shares ISA, making £20k of your holding totally tax free.

What else is out there?

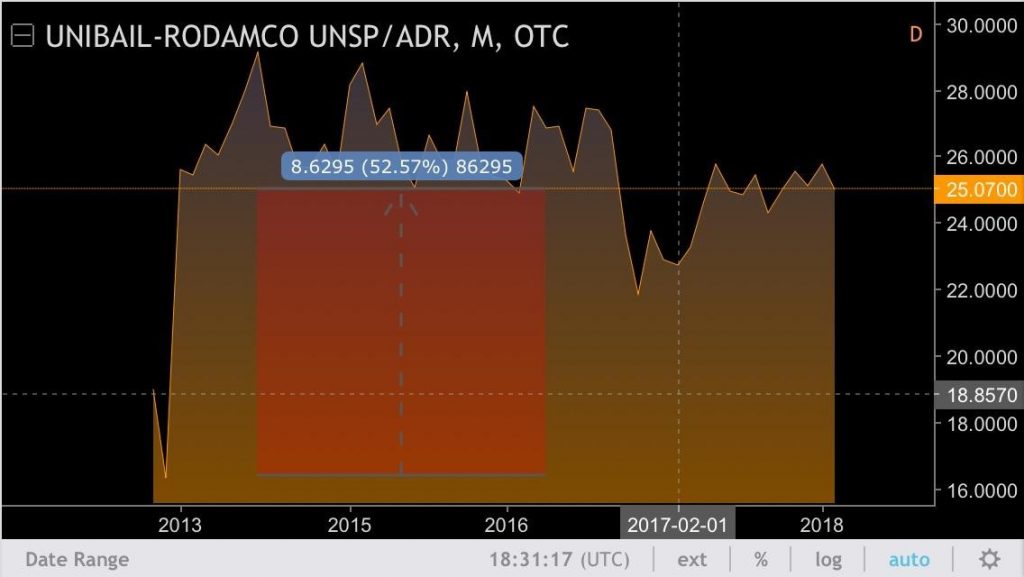

Land Sec PLC isn’t just the only REIT, they’re probably just the biggest and most lucrative. Another one I really like is Unibail-Rodamco who have recently bought Westfield Group.

Since 2013, their price has increased by 50%, again, very good gains.

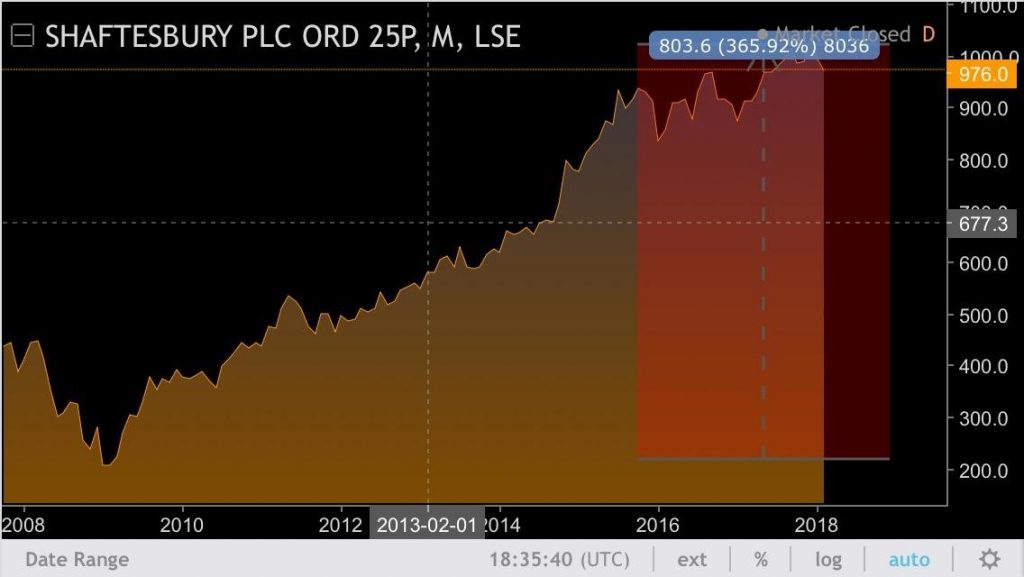

The third one that I like the look of is Shaftesbury Group purely because it has a good dividend, paying 7.9% last year (although its price looks pretty overvalued at 350% growth since 2013).

Take a look… It looks like the increase in the Bank of England’s balance sheet.

How do I set up an ISA to buy REITs?

The easiest way to do this is probably via Hargreaves Lansdown or Fidelity. However, there are many to choose from.

Email David any questions at dbelle@davidbellefx.com or visit his website.

Just a final warning, investing does carry risk and this is simply commentary and not intended to be used as investment advice.